THE VIEW FROM INSIDE

THE UPS AND DOWNS OF 2017

There is no crystal ball to predict precisely what will happen and when it will occur in the real estate market. Despite builders’ best efforts to examine existing conditions and deduce from the past, there are many government and economic influences over which we have no control. This past year has been especially unpredictable for housing across Canada, in Ontario and, here, in the GTA.

During 2017, housing has been affected by the implementation of the Ontario Fair Housing Plan. Among the 16 measures, many are focused on the rental market. However, included in the plan is a 15 percent Non-Resident Speculation Tax (NRST), which applies to homes purchased in the Greater Golden Horseshoe Area (GGHA) by non-citizens or non-permanent residents of Canada. This measure had a greater initial impact in “cooling” the market than is justified by the 5 per cent of the GGHA’s new sales attributed to non-resident buyers.

Additionally, the continued rise in house and condo prices creating red hot markets became a focus of the federal government, prompting an increase in lending rates, followed by a tightening of eligibility measures, and ultimately causing a ripple of buyer concern. On top of this, a multitude of confusing and conflicting media reports about what was happening in the resale and new housing market fueled further uncertainty among buyers and sellers alike.

With summer’s approach, many potential resale homebuyers in the GTA, perhaps fed up with bidding wars, sat on the sidelines waiting to see what would happen. Meanwhile, sellers gleefully believed in the rising price of their existing home despite sales to the contrary. By September, home prices had either levelled or were rising again, depending upon specific location. Throughout fall, sales in certain price ranges gained momentum

and it now appears that some stability is returning.

Turning to the new home market, the picture is a little different. The price of land continues to rise; municipalities are increasing development charges; and the cost of building, including skilled labour and materials, is holding or rising. These all have an impact on the end purchase price of a new home.

Here’s a snapshot of new home statistics from the Greater Toronto Area New Homes Monthly Market Report to the end of September 2017, according to data released by Altus Group: lowrise sales year-to-date were down 3 per cent over the same period in 2016, yet lowrise prices were up 21.4 percent over September 2016.

Those of us involved in the industry are optimistic that 2018 will bring further stability. Our economy is strong and lending rates remain historically low, which is good news. Our

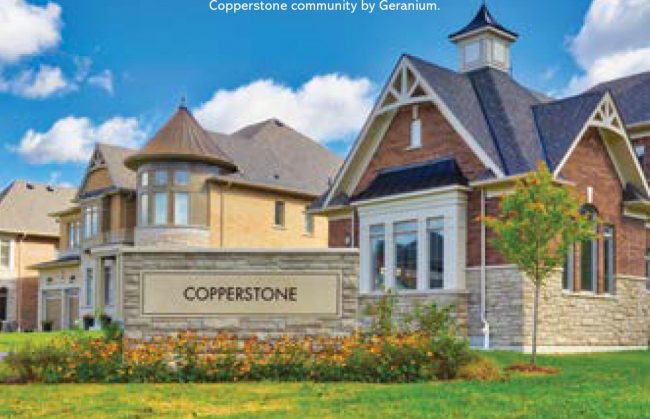

company is planning for continued demand for new homes, which we’ve done successfully for the past 40 years. The privilege of owning a home remains a Canadian dream for those who have been here for generations and newcomers alike.

On behalf of Geranium, we wish you and your families a safe and happy New Year.

Boaz Feiner, is president of Geranium and a former member of the BILD Board of Directors. Celebrating 40 years in business, Geranium has created many superb master-planned communities including more than 8,000 homes in Ontario.

Geranium.com